Putting some money aside for the future, whether for a big purchase, a rainy day, or just a little peace of mind, feels pretty good, doesn't it? When you think about where to keep those hard-earned funds, a savings account often comes to mind, and for a good reason. It’s a place where your cash can sit safely, and, with the right choice, it might even grow a bit on its own.

Figuring out where to put your extra cash can seem like a bit of a puzzle, especially when you start thinking about things like how much extra money your savings might earn. That earning potential, what we often call the interest rate, is a pretty important part of the whole picture. It’s the little bonus that gets added to your balance over time, making your money work a bit for you without you having to do anything else, which is kind of neat, you know?

For many folks, credit unions like CEFCU come up in conversations about where to stash their funds. They often have a reputation for being focused on their members, which can mean different things for your money, including how much it might grow. So, if you're curious about what a CEFCU savings account interest rate could mean for your financial goals, let's talk about it a little.

Table of Contents

- Why a Savings Spot Matters

- Finding the Right Place for Your Cash

- How CEFCU Helps Your Money

- Getting Started with CEFCU

- Making the Most of Your Savings

- Keeping an Eye on Your Savings

- A Look Back at Your Savings Options

Why a Savings Spot Matters

Having a special place for your money, like a savings account, is pretty much a foundational step for anyone trying to get their finances in good shape. It’s not just about keeping your cash safe from accidental spending; it’s about setting up a dedicated spot for your future self. Think of it as building a little financial cushion, something that can help you feel more secure, you know, for whatever life throws your way.

What's a Savings Account For?

Basically, a savings account is a financial tool that helps you put money aside for specific purposes or simply for a rainy day. It's a spot where your cash can be kept separate from your everyday spending money, like what you have in a checking account. This separation helps you resist the urge to spend funds meant for bigger goals. For example, you might be saving for a down payment on a house, a new car, a vacation you’ve been dreaming about, or perhaps just to have an emergency fund for unexpected events. It's really about having that distinct pot of money that you don't touch unless it's for something important, or perhaps, a true emergency. So, it's pretty useful for financial planning.

How Does Interest Actually Help Your Money Grow?

This is where things get interesting, apparently. When you put your cash into a savings account, the financial institution, whether it’s a bank or a credit union like CEFCU, pays you a little bit extra for keeping your money with them. That extra bit is called interest. It’s like a small thank you payment for letting them use your money, even if it's just for a short time. The amount they pay you is based on a percentage of your balance, which is the interest rate. So, the higher that percentage, the more money you could potentially earn over time without having to add more of your own funds. It’s a pretty neat concept, really, because it means your money starts making money for you, which is the whole idea behind growing your wealth.

Finding the Right Place for Your Cash

Choosing where to put your money for safekeeping and growth is a decision that deserves a bit of thought. There are so many places out there, each with its own set of features and benefits. It’s a bit like picking the right kind of garden for your plants; you want the one that will help them flourish best. Your money, similarly, needs a good spot to really thrive, and that often means looking at more than just the surface details.

What to Look For in a Savings Account, Generally

When you're checking out different savings accounts, there are a few things you'll probably want to keep in mind. First off, the interest rate is obviously a big one; you want your money to earn as much as it possibly can. But that's not the only thing, you know? You should also think about any fees that might pop up, like monthly service charges or fees for taking money out too often. Some accounts might have a minimum balance requirement, meaning you need to keep a certain amount in there to avoid fees or earn the best rates. Then there’s how easy it is to get to your money when you need it. Is it simple to transfer funds, or are there limits? These little details can really make a difference in how useful an account is for you, so it's good to consider them all, basically.

Considering CEFCU Savings Account Interest Rates

When it comes to a CEFCU savings account interest rate, you're looking at what a credit union might offer. Credit unions are a bit different from traditional banks because they're owned by their members. This often means they can sometimes offer rates that are, in some respects, pretty competitive, and their fees might be lower too. They typically focus on giving benefits back to their members rather than just making profits for shareholders. So, when you look at a CEFCU savings account, you're not just considering the number that represents the interest rate; you're also thinking about the overall value of being part of a member-focused organization. It's about finding a good balance between what your money earns and the kind of service and support you get. You know, it's pretty important to weigh all those aspects.

How CEFCU Helps Your Money

CEFCU, like other credit unions, operates with a slightly different philosophy than a big, traditional bank. Their main goal is to serve their members, which can translate into various benefits for your financial well-being. This member-centric approach can mean different things for your savings, including how much your money might grow over time. It’s really about being part of a community that aims to help each other out, financially speaking, which is a bit different from other places.

A Closer Look at CEFCU's Approach to Savings

CEFCU tends to offer a variety of savings options, usually designed to fit different kinds of financial goals. They might have standard savings accounts, perhaps some money market accounts, or even certificates of deposit (CDs), each with its own way of helping your money grow. The idea is to give members choices, so you can pick the option that best fits how long you want to save and how much access you need to your cash. Their approach often focuses on providing value, which could mean a decent CEFCU savings account interest rate, or perhaps lower fees, or even just more personalized service. It’s about creating a helpful environment for your funds, so they can do their job for you, more or less.

Are CEFCU Savings Account Interest Rates Competitive?

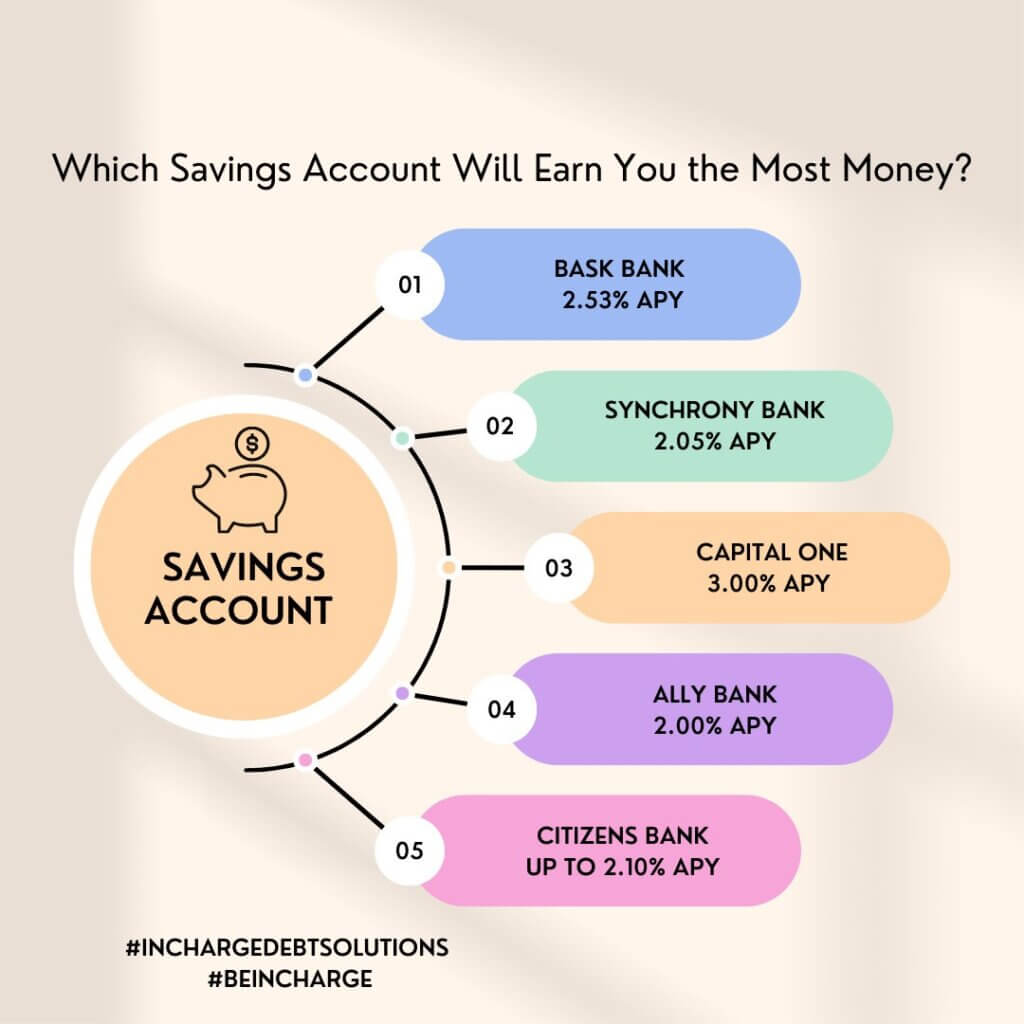

When you're trying to figure out if a CEFCU savings account interest rate is a good deal, you'll probably want to compare it with what other places are offering. Credit unions, as a rule, sometimes have the ability to provide rates that are pretty attractive, especially when compared to some of the bigger banks. This is because, as member-owned organizations, they can pass more of their earnings back to you, the member, in the form of better rates or fewer fees. So, while you won't find specific numbers here, it's generally a good idea to check their current offerings and stack them up against similar products from other financial institutions. You might find that, for your particular needs, their rates are quite favorable, which is something to think about, definitely.

Getting Started with CEFCU

If you're thinking about putting your money into a CEFCU savings account, the process is usually pretty straightforward. It’s like signing up for any new service, where you provide some basic information and then you’re good to go. They want to make it as simple as possible for you to begin your savings journey with them, which is helpful, you know?

What Steps Do You Take to Open a CEFCU Savings Account?

To open a CEFCU savings account, you’ll typically need to meet a few requirements and provide some personal details. This usually includes things like your identification, perhaps a social security number, and some contact information. You might also need to make an initial deposit to get the account started. Many financial places allow you to begin this process online, which is quite convenient, or you could visit one of their physical locations if you prefer to talk to someone in person. They usually have clear instructions on their website about what you need to bring or have ready. It's generally a pretty simple procedure, so you can get your money working for you fairly quickly.

Getting Help with Your CEFCU Savings Account

Sometimes, you might run into a question or need some assistance with your account, and that's perfectly normal. If you happen to be using a screen reader or some other kind of aid and are having a little trouble using their website, you can always reach out to them directly. They want to make sure everyone has a fair chance to access their services. You can get in touch with them by calling 1.800.633.7077. They also have a special page on their website dedicated to accessibility help, which can be a good spot to check out if you're looking for more information or specific support. Plus, if you already have applications going, you can usually get to them using your online profile or by verifying your email, which is pretty handy, as a matter of fact.

Making the Most of Your Savings

Just having a savings account is a great first step, but truly making your money grow involves a bit more than just opening an account. It’s about how you use it and how you think about your financial goals. You want to make sure your efforts are really paying off, so to speak, and that you're getting the best possible benefit from your CEFCU savings account interest rate.

Tips for Growing Your Money with CEFCU Savings

To really see your money flourish in a CEFCU savings account, there are a few simple habits you could try to adopt. One big one is to set up automatic transfers from your checking account to your savings. Even a small amount each week or month can really add up over time, and you probably won't even miss it. Another idea is to make extra deposits whenever you have some unexpected cash, like a bonus or a tax refund. The more money you have in your account, the more interest you can earn, so it's a pretty good idea to add to it whenever you can. Also, try to avoid taking money out unless it’s absolutely necessary, because keeping your balance high helps your earnings grow more consistently. These little actions can make a big difference in how much your CEFCU savings account interest rate benefits you, actually.

Why a CEFCU Savings Account Interest Rate Matters for Your Future

The interest rate on your CEFCU savings account might seem like just a small number, but over time, it can play a surprisingly big role in how much money you end up with. This is because of something called compound interest, which means you earn interest not only on the money you put in but also on the interest you've already earned. It’s like a snowball effect, where your money starts to grow on itself. So, even a slightly better CEFCU savings account interest rate can mean hundreds or even thousands of extra dollars for you over many years. This extra growth can help you reach your financial goals faster, whether it’s buying that first home, funding your retirement, or just having a more comfortable cushion for whatever comes next. It’s a pretty powerful thing, really, to have your money working hard for you.

Keeping an Eye on Your Savings

Once you’ve got your savings account up and running, it's a good idea to check in on it every now and then. You wouldn't plant a garden and then never look at it, would you? Your savings are a bit like that; they need a little attention to make sure they're doing what you want them to do. It's about staying connected with your money, you know, making sure it’s on the right path.

Checking on Your CEFCU Savings Account Interest Rates?

Interest rates can change over time, depending on what's happening in the wider economy. So, it’s a good habit to periodically check the current CEFCU savings account interest rates. You can usually find this information on their website, or you could even give them a call. Knowing the current rate helps you understand how much your money is earning and if it’s still the best place for your funds. If rates go up, you might find your money growing even faster, which is great. If they go down, it might be a good time to think about other savings options CEFCU offers or simply understand how it affects your overall plan. It's really about being informed, basically, so you can make smart choices for your cash.

Staying Informed About Your Money

Beyond just the interest rate, it’s generally a good idea to keep an eye on your account statements and any communications from CEFCU. This helps you track your balance, see how much interest you've earned, and notice any changes to account terms or conditions. Most financial institutions, including CEFCU, offer online banking or mobile apps that make it super easy to check your account whenever you want. Staying informed helps you feel more in control of your money and ensures you’re making the most of your CEFCU savings account. It's like keeping a good watch on your financial health, which is pretty important, you know?

A Look Back at Your Savings Options

Thinking about a CEFCU savings account and its interest rates means looking at a place where your money can truly grow while being part of a community-focused organization. We’ve covered how savings accounts work, why interest matters, and what makes CEFCU a choice many people consider. We also talked about how to get started, how to get help if you need it, and ways to make your savings work harder for you. Keeping an eye on your account and staying informed about those CEFCU savings account interest rates can help you feel more confident about your financial decisions and ensure your money is always moving in the right direction for your future goals. It's all about making smart choices for your cash, more or less.