gomyfinance.com Create Budget - Your Money Story

Feeling like your money slips through your fingers, almost like sand? Many people feel this way, so you are not alone in this experience. Getting a clearer picture of where your earnings go can make a real difference in how you feel about your finances. When you know what is happening with your cash, you get a sense of control, which can be a very calming thing. This kind of awareness helps you make choices that line up with what you want for your future.

It can feel a bit like a guessing game sometimes, figuring out where every dollar goes. Bills come in, expenses pop up, and before you know it, the money you had is gone, and you are left wondering what happened. This common feeling of not quite knowing where you stand with your cash flow can cause a lot of worry. Yet, getting a handle on your money does not have to be a source of stress; it can actually be a simple process if you have the right kind of support. That is where a good system comes into play, helping you see things clearly.

That is why a tool like gomyfinance.com, which helps you create a budget, could be just what you need to bring some order to your financial world. It offers a straightforward way to keep track of your income and your spending, giving you a proper look at your money habits. By using something that simplifies this task, you can move from feeling unsure to feeling quite sure about your financial path. It is about setting up a clear path for your money, so it works for you.

Table of Contents

- Why bother with a spending plan?

- How can gomyfinance.com create budget help?

- What makes gomyfinance.com create budget different?

- Getting started with gomyfinance.com create budget

- Is gomyfinance.com create budget right for you?

- Beyond the basics - gomyfinance.com create budget and your future

- Common questions about gomyfinance.com create budget

- What people say about gomyfinance.com create budget

Why bother with a spending plan?

You might be asking yourself, "Why should I even bother with a spending plan?" Well, it is a bit like having a map when you are going on a trip. Without a map, you might just wander around, maybe get lost, and definitely not get to your desired spot as quickly or as smoothly as you could. With your money, a spending plan, or a budget, acts as that very guide. It shows you where your money comes from and where it is going, which is actually a pretty big deal. This way, you can avoid unexpected money troubles and make sure you have enough for what truly matters to you. So, in some respects, it is about having peace of mind and knowing you are on the right track with your funds.

Many people find that without a clear idea of their money flow, they might spend more than they bring in, leading to a feeling of being short on cash at the end of the month. This can create a cycle of worry and can stop you from reaching bigger money goals, like saving for a down payment on a house, paying off debt, or putting money aside for a fun vacation. A spending plan helps you break that cycle. It gives you the chance to make choices about your money on purpose, rather than just letting things happen. You get to decide where your money goes, which is a powerful feeling, you know? It is about making your money work for you, instead of feeling like you are always chasing it.

Having a spending plan also helps you spot areas where you might be spending without realizing it. Maybe you are buying coffee out every day, or perhaps those online subscriptions are adding up faster than you thought. When you see these patterns clearly laid out, it becomes easier to make small changes that can add up to a whole lot of extra money over time. This extra cash can then be put towards things that genuinely improve your life, like building up an emergency fund or investing in your future. It is about being smart with what you have, and really, that is something everyone can do.

How can gomyfinance.com create budget help?

So, you are thinking about getting a handle on your money, but perhaps the idea of creating a budget seems a bit much. That is where gomyfinance.com comes in to help you create a budget with less fuss. This platform is built to make the whole process simpler and more friendly. Instead of feeling like you are doing complicated math or wrestling with spreadsheets, gomyfinance.com gives you a clear pathway to setting up your money plan. It helps you see where your earnings are going and how much you have left for different things, all in a way that just makes sense. It is almost like having a friendly guide for your money matters.

One of the ways gomyfinance.com helps you create a budget is by letting you put in your income and all your regular bills. This gives you a starting point, a basic picture of what comes in and what goes out each month. From there, you can begin to add in your other spending, like groceries, transportation, or even fun activities. The system then shows you how everything adds up, so you can easily see if you are spending more than you are earning. This kind of clear picture is incredibly helpful, as a matter of fact, because it removes the guesswork and replaces it with solid facts about your financial situation.

What is really neat about using gomyfinance.com to create a budget is how it helps you keep track of things over time. You can see your spending habits change, and you can adjust your plan as your life changes. Maybe you get a raise, or perhaps you have a new expense pop up. The platform lets you update your budget quickly, so it always reflects your current situation. This flexibility means your budget stays a useful tool, not just a one-time thing you set up and forget. It is a living document, really, that moves with you through your financial life, helping you stay on track.

What makes gomyfinance.com create budget different?

You might be wondering, with all the tools out there, what makes gomyfinance.com stand out when you want to create a budget? Well, one of the main things is its focus on making the process feel less like a chore and more like a helpful chat about your money. Many people find that other budgeting tools can be overly complicated, with too many buttons and options that just confuse things. gomyfinance.com, on the other hand, tries to keep things straightforward. It gives you the important information you need without overwhelming you with details you might not care about right away. This simplicity is a big part of its charm, you know?

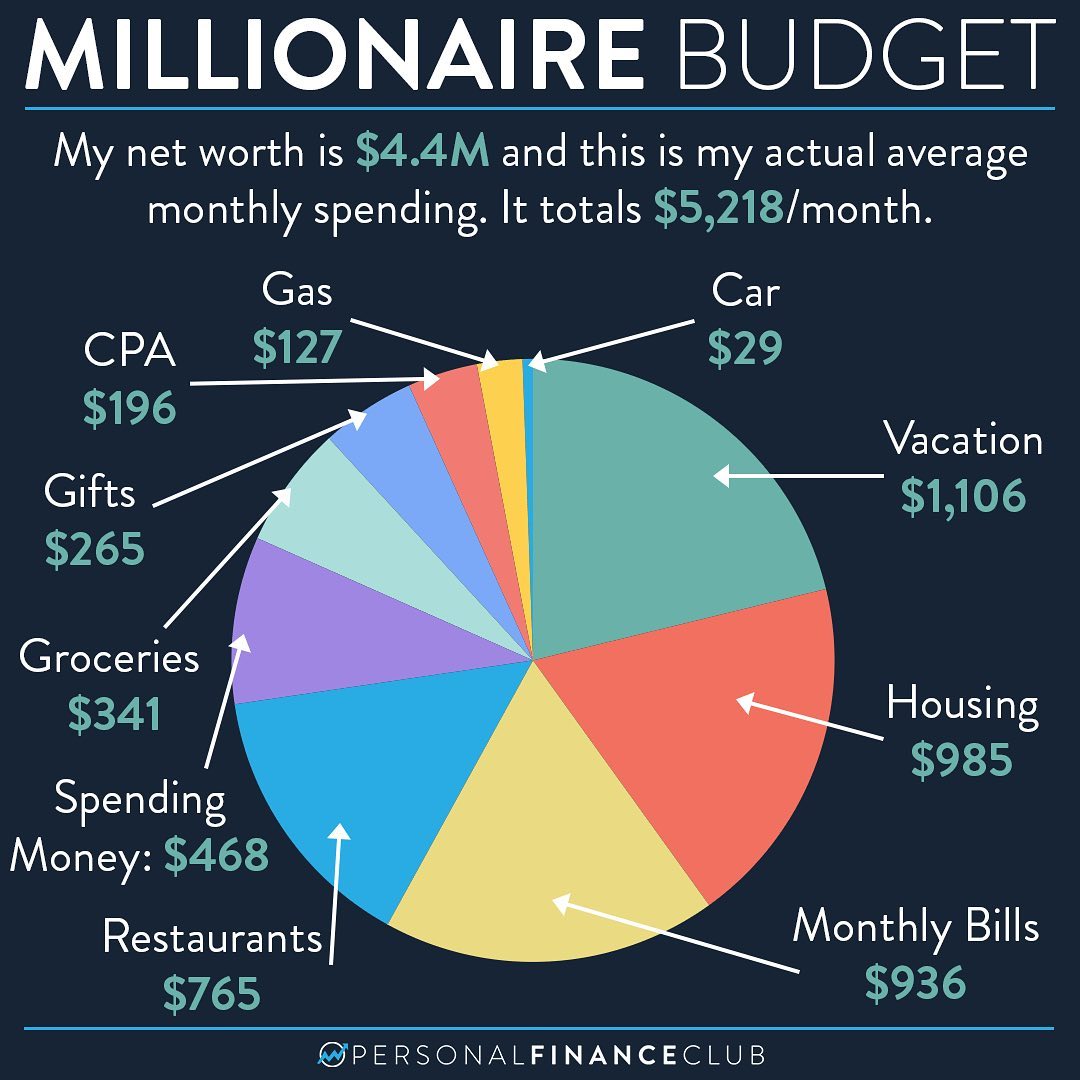

Another aspect that sets gomyfinance.com apart for those who want to create a budget is its friendly presentation of your financial information. Instead of just showing you rows of numbers, it often presents your data in ways that are easy to look at and make sense of, perhaps with simple charts or clear summaries. This visual approach helps you grasp your money situation quickly, allowing you to see trends and areas where you might want to make changes without having to dig through a lot of text. It is about getting to the point and giving you insights at a glance, which is pretty useful for anyone trying to manage their funds.

Furthermore, the way gomyfinance.com helps you create a budget encourages a positive relationship with your money. It is not about feeling restricted or deprived; it is about feeling empowered and in control. The platform helps you set money goals and then shows you your progress toward them, which can be very motivating. Seeing how your efforts are paying off can make sticking to your plan much easier. This focus on progress and positive reinforcement, as a matter of fact, is what helps people stay with their budgeting efforts for the long haul. It helps you build good money habits that last.

Getting started with gomyfinance.com create budget

So, you are ready to give it a try and use gomyfinance.com to create a budget. The good news is that getting started is quite simple. You do not need to be a money expert or spend hours figuring things out. The first step is usually to sign up for an account, which typically involves providing some basic information. This process is generally quick and designed to get you up and running without any delays. They make it pretty easy to jump right in, which is a big plus for anyone who might feel a bit hesitant about starting something new with their money.

Once you have an account, the next thing you will want to do is put in your income. This means listing all the money you expect to receive in a given period, like your paycheck or any other regular earnings. After that, you will start adding your expenses. This could be your rent or mortgage payment, utility bills, and other fixed costs. Then, you will move on to your variable spending, like what you spend on groceries, going out, or personal care. The system helps you categorize these, making it clear where your money is actually going. It is a step-by-step process, so you do not have to do it all at once, you know?

As you add your income and spending, gomyfinance.com starts to put together your budget picture. It will show you how much money you have left over after your bills are paid, or if you are spending more than you earn. You can then adjust your spending plans as needed. Maybe you decide to cut back on eating out or find ways to save on groceries. The platform gives you the information you need to make these kinds of decisions. It is about making small, workable changes that add up to a big difference in your money situation. You can even set reminders, which is quite helpful for keeping up with your plan.

Is gomyfinance.com create budget right for you?

You might be asking yourself, "Is gomyfinance.com the right tool for me to create a budget?" Well, if you are someone who feels a bit overwhelmed by money matters, or if you have tried budgeting before and found it too difficult to stick with, then this platform could be a good fit. It is built with simplicity in mind, aiming to make money management feel less like a chore and more like a helpful habit. If you are looking for a way to get a clearer view of your money without getting bogged down in too many details, then it is very likely something worth considering. It is about making budgeting accessible to everyone, basically.

If you are someone who prefers a straightforward approach to managing your funds, without a lot of fancy features you will never use, then gomyfinance.com could be a solid choice for you to create a budget. It focuses on the core aspects of budgeting: tracking income, tracking expenses, and seeing where your money goes. It does not try to do too many things at once, which can be a relief for people who just want to get the basics down. This focused approach means you can get started quickly and begin to see results without a steep learning curve. It is about practical money management, pure and simple, which many people find appealing.

Also, if you are someone who values being able to see your financial situation at a glance, then the way gomyfinance.com helps you create a budget will probably appeal to you. The platform aims to present information in a way that is easy to understand, so you can quickly get a sense of your money flow. This means less time spent crunching numbers and more time understanding what your money is doing. If you are ready to take a step toward feeling more in control of your earnings and spending, and you appreciate a clear, easy-to-use tool, then gomyfinance.com might just be the right choice for your money management needs. It is worth looking into, anyway.

Beyond the basics - gomyfinance.com create budget and your future

Once you get comfortable with using gomyfinance.com to create a budget and track your daily spending, you will find that the tool can help you think about your money in bigger ways, too. It is not just about what you spend today; it is also about what you want for tomorrow. By seeing your spending patterns over time, you can start to identify areas where you might be able to save more for future goals. Maybe you dream of buying a house, or perhaps you want to save up for a child's education, or even plan for a comfortable retirement. The insights you gain from your budget can help you work towards these bigger aspirations.

The platform, in helping you create a budget, also gives you a clearer picture of your financial health, which is really quite important for long-term planning. You can see how much you are consistently saving, or if you are consistently spending more than you earn. This kind of consistent look at your money allows you to make informed decisions about big financial steps. For example, if you see that you have a good handle on your monthly expenses, you might feel more confident about taking on a new financial commitment, like a car payment or a personal loan. It is about building a solid foundation for your money future, essentially.

Using gomyfinance.com to create a budget helps you build a habit of financial awareness that can serve you well for years to come. It helps you think about your money not as something separate from your life, but as a tool that can help you live the life you want. By regularly checking in with your budget, you become more mindful of your choices and how they impact your financial standing. This ongoing practice of money awareness is a powerful thing, really, because it helps you stay on course for your financial dreams, whatever they may be. It is about making smart money moves, day after day, for a brighter tomorrow.

Common questions about gomyfinance.com create budget

People often have questions when they are thinking about trying out a new tool, especially one that deals with their money. When it comes to gomyfinance.com and its ability to help you create a budget, some common thoughts pop up. For instance, many people wonder about how safe their information is. Reputable platforms usually put a lot of effort into keeping your data secure, using various protections to make sure your personal and financial details are kept private. It is something they take very seriously, as a matter of fact, to build trust with their users. So, that is generally a big focus for them.

Another frequent question is about how easy it is to link bank accounts or other financial places. Most budgeting tools, including ones like gomyfinance.com that help you create a budget, try to make this process as smooth as possible. They often use secure connections that let you bring in your transaction data automatically, saving you the trouble of putting everything in by hand. This makes keeping your budget up to date much simpler and less time-consuming. It is about making the process convenient for you, so you can spend less time on data entry and more time on actually understanding your money.

People also often ask if there are any hidden costs or if the basic features for using gomyfinance.com to create a budget are free. Many platforms offer a free version with core budgeting abilities, and then they might have paid options for more advanced features. It is always a good idea to check their website for details on pricing and what is included in different plans. This way, you can pick the option that best fits what you need and what you are comfortable paying. Knowing these things upfront helps you make a good choice about whether the tool is right for your money management needs.

What people say about gomyfinance.com create budget

When you are thinking about trying a new service, especially one that helps you with your money, it is natural to want to hear what others have experienced. People who have used gomyfinance.com to create a budget often share how much easier it has made managing their money. They talk about feeling less stressed and more in control of their finances. Many users point out that the simple way the platform shows their spending helps them spot areas where they can save, which they might not have noticed before. This kind of feedback suggests the tool is doing a good job of making budgeting more accessible, you know?

Some users also mention that the clear layout of gomyfinance.com helps them stick with their budgeting efforts. They say that because it is not overly complicated, they are more likely to log in regularly and keep their information current. This consistency is a big part of successful money management, and it seems the platform helps people build that habit. It is not just about setting up a budget once; it is about keeping it going, and people seem to appreciate how the tool supports that ongoing effort. This makes it a helpful companion for anyone trying to get a better grip on their money.

Others who have started to create a budget with gomyfinance.com express a sense of achievement as they watch their savings grow or their debt go down. Seeing their progress laid out clearly gives them a feeling of accomplishment, which encourages them to keep going. This positive feedback loop is a strong motivator for many. It is about turning what might feel like a difficult task into something that brings a sense of success and financial freedom. So, it seems the tool really does help people feel better about their money situation, which is a pretty great outcome for a budgeting platform.